does new hampshire charge sales tax on cars

States like Montana New Hampshire Oregon and Delaware do not have any car sales tax. What states have the highest sales tax on new cars.

While states like North Carolina and Hawaii have lower sales tax rates below 5.

. As one example of this Hawaii has an 425 on the scale. Mootor Vehicle Tax based on vehicle value. New Hampshire is one of the few states with no statewide sales tax.

When you need a new car in New Hampshire you dont have to pay sales tax which is one of only five states without a sales tax. Only five states do not have statewide sales taxes. No inheritance or estate taxes.

Supplemental Govermental Services Tax based on vehicle value. Unfortunately unless you register the car in the sales-tax-free state you will still have to pay the sales tax when you register. The majority of states45 and the District of Columbia as of July 2021impose a sales tax at the state level.

Montana Alaska Delaware Oregon and New Hampshire. New Hampshire is one of just five states that do not have a sales tax so youre in luck when you need to purchase a vehicle. For more information on motor vehicle fees please contact the NH Department of Safety.

States With No Sales Tax on Cars. Alaska Delaware Montana New Hampshire and Oregon do not. Montana additionally imposes some special taxes in resort.

New Hampshire does collect. The most straightforward way is to buy a car in a state with no sales taxes and register the vehicle there. Unfortunately unless you register the car in the sales-tax-free state you will still have to pay the sales tax when you register the vehicle with your home states DMV.

The New Hampshire state sales tax rate is 0 and the average NH sales tax after local surtaxes is 0. If you purchase a vehicle in New Hampshire but register it in another state you must pay sales tax for the state of registration. New Hampshire Delaware Montana Oregon and Alaska.

There are however several specific taxes levied on particular services or products. The state where you pay vehicle registration fees is the one that charges the sales tax not the state where you made the vehicle purchase. Some other states offer the opportunity to buy a vehicle without paying sales tax.

The New Hampshire state sales tax rate is 0 and the average NH sales tax after local surtaxes is 0. There are however several specific taxes levied on particular services or products. There are five states that dont charge sales tax on cars registered within the state.

Some states such as Montana Delaware Oregon and New Hampshire do not charge sales taxes of more than 5. Exact tax amount may vary for different items. Rental companies have the optoion to charge individually itemized charges or fee on rentals for a period of less than 31 days.

The sales tax rate of 935 applies to rental or lease of a passenger motor vehicle for a period of 30 or more days. Governmental Services Tax based on vehicle value. New Hampshire is one of the five states in the USA that have no state sales tax.

Property taxes that vary by town. You can find these fees further down on. In addition to taxes car purchases in New York may be subject to other fees like registration title and plate fees.

The Department has no authority to issue a certificate. You may however pay a local property tax for the vehicle when you register it. Mississippi - Plus 5 state sales tax 2.

Are there states with little to no sales tax on new cars. Regardless of how you register your car if you live in New Hampshire you wont need to pay sales tax on the purchase. New Hampshire does not charge sales tax on vehicles.

No there is no general sales tax on goods purchased in New Hampshire. So if you live in Massachusetts a state that has sales tax but buy a car in New Hampshire a state with no sales tax you will still have to pay tax to your home state of Massachusetts when you go to get your license plates. There are however several specific taxes levied on particular services or products.

The Granite States low tax burden is a result of. A 9 tax is also assessed on motor vehicle rentals. There are also a county or local taxes of up to 45.

States with some of the highest sales tax on cars include Oklahoma 115 Louisiana 1145 and. Louisiana - Levies a 25 state tax plus 05 local tax. As of 2019 our research has found that five states have 0000 sales tax.

New Hampshire does not have a sales tax. How do I get a sales and use tax exemption certificate. According to various sources New Hampshire has the lowest registration fees and no sales tax on new cars which makes the state the cheapest in.

New York collects a 4 state sales tax rate on the purchase of all vehicles. A 9 rooms and meals tax also on rental cars A 5 tax on dividends and interest with a 24004800 exemption plus additional exemptions. Does New Hampshire have a sales tax.

Montana Alaska Delaware Oregon and New Hampshire. 3120 and up based on type and weight plus 10. 5-30 motor vehicle fee.

As long as you are a resident of New Hampshire you wont need to pay sales tax on the purchase of your car even when you go to register it. Some states do not charge sales taxes on cars as well. No capital gains tax.

However if you live in neighboring Vermont Maine or Massachusetts you cannot simply go to New. Only Oregon Montana New Hampshire Alaska and Delaware dont tax sales as of 2021 but Alaska allows local counties and municipalities to levy sales taxes of their own. Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85.

Motor vehicle fees other than the Motor Vehicle Rental Tax are administered by the NH Department of Safety. 2022 New Hampshire state sales tax. These five states do not charge sales tax on cars that are registered there.

Purchase location does not determine sales tax for a vehicle state of registration does. Washington DC the nations capital does not charge sales tax on cars either. New Hampshire is one of the few states with no statewide sales tax.

These excises include a 9 tax on restaurants and prepared food consumed on-premises a 9 tax on room and car rentals a tax of 000055. Only five states do not have statewide sales taxes. New Hampshire is one of the few states with no statewide sales tax.

New Hampshire Vehicle Sales Tax Fees Find The Best Car Price

What S The Car Sales Tax In Each State Find The Best Car Price

New Hampshire State Veteran Benefits Military Com

New York Car Sales Tax Calculator Ny Car Sales Tax Facts

New Hampshire Bills Of Sale Facts To Know Templates To Use

Register A Car In New Hampshire Maine Massachusetts

My Vehicle Title What Does A Car Title Look Like Car Title Title Nevada

New Hampshire Vehicle Sales Tax Fees Find The Best Car Price

90s Formula Ad 2 Pontiac Firebird Pontiac Pontiac Cars

If I Buy A Car In Another State Where Do I Pay Sales Tax

If I Buy A Car In Another State Where Do I Pay Sales Tax

When You Buy A Car From New Hampshire Is There Sales Tax Sapling

New Hampshire Leads The Way In Car Ownership Costs

Nj Car Sales Tax Everything You Need To Know

New Hampshire Bills Of Sale Facts To Know Templates To Use

How To Sell A Car In New Hampshire The Dmv Rules For Sellers

New Hampshire Vehicle Sales Tax Fees Find The Best Car Price

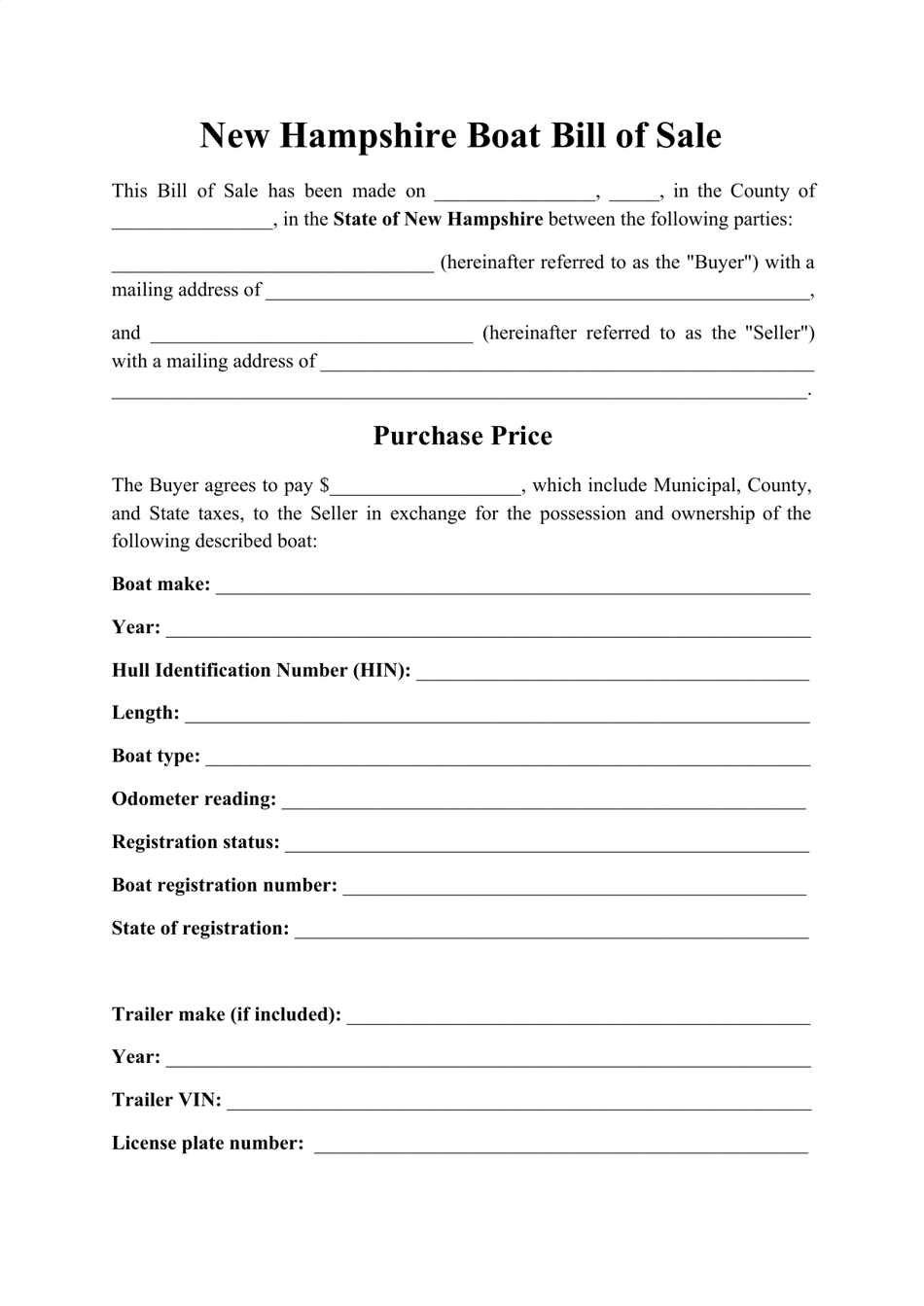

New Hampshire Boat Bill Of Sale Form Download Printable Pdf Templateroller